If you're venturing into the entire world of homeownership for The very first time, you will find that comprehension your funds can be an indispensable first step. It's actually not nearly just how much you can borrow; it's also about recognizing Everything you can comfortably afford devoid of stretching your self too slim. This balance is crucial, since it impacts your ability to take a look at several house loan alternatives effectively. But How will you decide what that balance seems like, and Exactly what are the hidden prices which could capture you off guard? Let's discover what it's going to take for making a economically seem conclusion in the journey towards obtaining your 1st residence.

Before diving into your home-looking procedure, you might want to grasp your monetary situation carefully. Start by assessing your current income, savings, and charges to ascertain simply how much you may afford to spend on a new house without having overstretching.

It really is important to think about not simply the purchase price and also ongoing prices like house taxes, homeowners insurance, and routine maintenance.

You will need to evaluate your credit history rating as well, as it greatly influences loan conditions offered to you. In case your rating is small, you might want to expend a while improving it to secure far better fees.

As you recognize your fiscal health, it is time to discover mortgage loan options that match your finances and homeownership plans.

You will find a number of kinds to choose from, which include mounted-fee, adjustable-price, and federal government-backed loans like FHA, VA, or USDA. Each style has special Positive aspects and drawbacks.

Preset-fee home loans offer security with constant month to month payments, whilst adjustable-charge home loans may start with decrease premiums but can change over time.

Govt-backed possibilities can be appealing if you're looking for decreased down payments or have precise requires like staying a veteran.

It truly is critical to match premiums, terms, and complete expenses from several lenders to make sure you get the very best offer.

You should not hurry; just take your time and effort to grasp Each and every possibility comprehensively.

Right after Discovering house loan solutions, it's time to shift your aim to locating the proper property.

Start off by listing what you'll need: number of bedrooms, garden Place, and proximity to operate or schools. Take into consideration your Life-style and foreseeable future programs. Do you need a house Workplace? Home to get a escalating family?

Following, analysis neighborhoods. Seek out locations that match your basic safety, advantage, and aesthetic preferences.

Remember to check out nearby facilities like parks, stores, and places to eat.

Seek the services of a reliable real estate property agent who is aware of the world well. They can offer a must have assistance, from identifying homes that fulfill your criteria to navigating home excursions.

Now that you've uncovered your suitable residence, it is time to make a proposal. This pivotal action entails read more several vital parts.

First, establish your Preliminary bid. Take into account the residence's current market benefit, your spending budget, and the amount you truly want your home. It's smart to consult together with your real estate property agent to strategize dependant on present-day market tendencies.

Upcoming, get ready a formal offer letter. This doc should really include your proposed selling price, wished-for closing day, and any contingencies, such as passing a home inspection or securing financing.

Be Prepared to negotiate; sellers might counter your supply, necessitating you to choose no matter whether to meet their phrases, revise your bid, or stroll away. Earning a wise provide sets the phase for A prosperous order.

Closing the offer in your new home can feel just like a marathon's last sprint. You are approximately on the complete line, but a couple of critical steps continue to be.

1st, you are going to evaluation and sign a stack of lawful paperwork, which legally transfer ownership to you. It truly is vital you recognize these papers, so Do not hesitate to inquire your real-estate agent or lawyer to clarify something perplexing.

Up coming, You will need to deal with the closing expenditures, which usually range between two% to five% of the house's order price tag. These involve service fees for financial loan processing, title coverage, plus more.

Be sure you've budgeted for these bills.

Purchasing a house can in the beginning drop your credit history score due to tough inquiry and new credit card debt.

Nevertheless, creating consistent home loan payments can increase your score over time.

It can be a substantial economic dedication.

You should purchase a house following a current career change, website but lenders may perhaps review your work security and profits continuity to make sure you can meet your mortgage obligations consistently.

You'll want to take into consideration purchasing a property warranty, as it may cover unanticipated repair service charges, which might save you dollars and reduce worry if big appliances or techniques break down soon after your order.

Buying a residence affects your taxes; You will likely get deductions on mortgage desire and house taxes.

On the other hand, it's complicated, and Gains change, so take into account consulting a tax Skilled to maximize your rewards.

Property taxes can maximize every year, determined by local government assessments and spending budget wants.

You will see variations according to assets value reassessments or shifts in municipal funding demands.

It truly is critical to spending plan for probable boosts.

Make sure to critique your funds cautiously, explore all mortgage loan choices obtainable, and select a home that fits both equally your needs and spending plan. Make your offer you confidently but wisely, holding potential prices in mind. Eventually, when closing the deal, assure all the necessary checks and paperwork are dealt with meticulously. By pursuing this guidebook, you are environment yourself up for An effective and satisfying dwelling-acquiring journey. Welcome property!

Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Christy Canyon Then & Now!

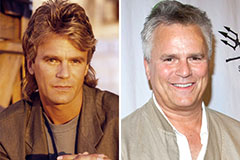

Christy Canyon Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!